The AGO’s Collections Enforcement Section collects debts on behalf of 400+ unique clients, including state agencies, universities and local governments. Collectively, they are owed more than $63 billion, which is money that cannot be used to provide services for Ohioans or to pay the employees needed to provide those services. Collections Enforcement is proud that its work returns money to the entities to fund these important functions.

For 20+ years, Collections Enforcement has relied on the Columbia Ultimate Business Systems (CUBS), a dinosaur of a system that makes timely and efficient collections difficult for all parties. Because it can no longer connect with external partners’ newer systems, some duties must be handled by written memos, and its inefficiencies even prevent common-sense solutions, such as payment plans.

The AGO is replacing the outdated CUBS with C&R Software’s Debt Manager, a robust, industry-leading system that will help collect more debts, improve efficiency and ensure compliance with state and federal requirements.

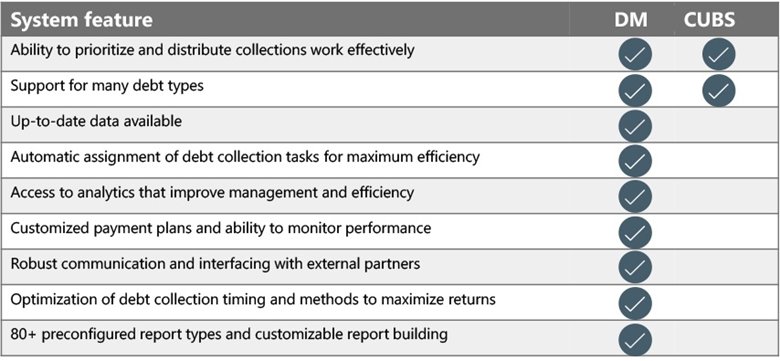

Compared with the outdated CUBS, the C&R Software Debt Manager system is highly flexible. Among its many attributes, Debt Manager will:

- Allow for long-term continual improvement of the platform.

- Facilitate greater responsiveness and customer service.

- Automate processes now completed manually by the Collections Enforcement staff.

- Facilitate improved system integration and transparency with client agencies, special counsel and third-party vendors.

- Allow for user-friendly interfaces for client agencies and Ohioans who owe money.

Here is a comparative look at the new C&R Software system versus the AGO’s legacy system:

Led by the CARES Program Team, the Attorney General’s Office is working with key stakeholders to take a 360-degree look at everyone impacted by the current system and collections process. What these experts are finding is that everyone involved will benefit from the CARES Program.

Clients: The public entities the AGO collects for – including state agencies, universities and local governments – will benefit from improved integration with their own systems, transparency and reporting capabilities. That will mean a reduction in manual work, increased debt recovery, improved responsiveness and more efficient service. As implementation of the CARES Program progresses, more clients will have the opportunity to engage in the process. (For the most recent updates, check the program timeline.)

External partners: The Special Counsel attorneys and third-party vendors hired by the AGO to handle collections work will likewise benefit from improved integration with their own systems, transparency and responsiveness. That will mean more efficient assignments of debt accounts and more resolutions.

Indebted parties: The individuals and businesses that owe the public entities will benefit from a system that is more user-friendly and responsive to their needs. It will provide enhanced self-service functionality and improved options such as payment plans.

The Attorney General’s Collections Enforcement Section: Team members will employ a more efficient process, including fewer manual steps, and will get tools to better measure, manage and improve collections activity. These benefits will lead to improved collections; a greater number of resolved accounts; and an improved customer-service experience for clients, external partners and indebted parties.