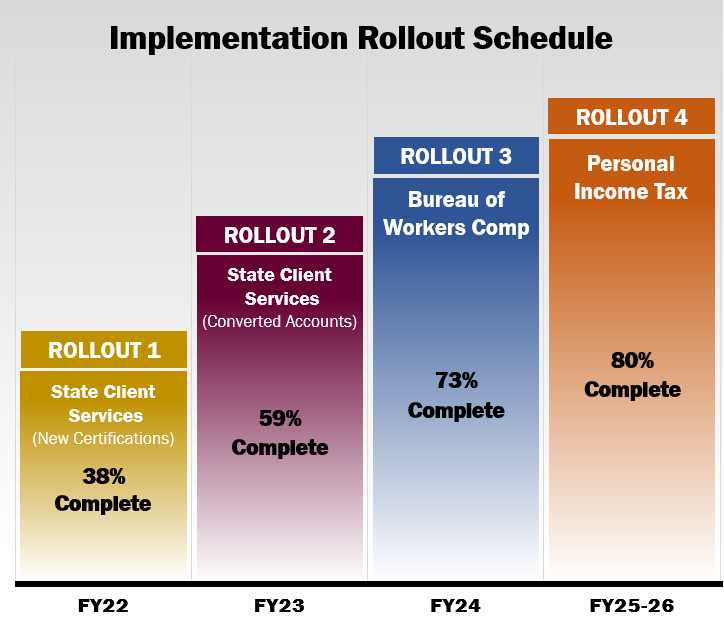

The Implementation Phase will consist of a series of distinct rollouts to transition AGO clients and external partners from the old system (CUBS) to the new Debt Manager system. This complex process will take multiple years to complete.

Rollout details

AGO clients and external partners will be divided into unique “business classes” for customized training, system testing and deployment. A key consideration in the overall implementation strategy is the sequencing of business classes, which determines the order in which Debt Manager is rolled out for each stakeholder group.

All business classes (see below for a full list) were evaluated for sequencing and suitability for the initial rollout based on factors that included:

- Business risk and complexity

- Statutory obligations

- Impact on organizational change management

- Development and configuration, including:

- Volume

- Complexity

- Timeline

Ultimately, we decided to begin with a limited number of clients in the business class known as State Client Services (Other state agencies). The CARES Program Team will work with our AGO clients and external partners to determine which business classes are involved in each subsequent rollout.

Our implementation plan gradually builds up the holistic system as each rollout is completed. The entirety of common workflows, interfaces, letters and reports are considered as the solution is built, with 80% of business class workflows completed by the end of Rollout 3. By the end of Rollout 4, 90% of business class workflows will be completed.

Business classes

The current implementation plan rolls out the new system by business class, a designation already used by the AGO’s Collections Enforcement Section. There are 11 business classes, listed here in alphabetical order:

- Bureau of Workers’ Compensation

- Business taxes

- Crime Victim Services

- Department of Job & Family Services

- Department of Medicaid

- Findings for Recovery

- Local governments

- Personal taxes

- State Client Services (Other state agencies)

- State universities

- University medical centers

Successful Rollout 1 Establishes Solid Foundation for CARES Debt Manager System

The implementation of the new CARES Debt Manager collections system is progressing smoothly, with Rollout 1 being completed as of July 18, 2022. This significant milestone involved the integration of 34 State Client Services (SCS) agencies and new certifications into the new system. Rollout 1 served as a vital phase to ensure that the new system operates as intended, while also laying the foundation for future enhancements. This article highlights the key accomplishments of Rollout 1 and emphasizes the core functionalities that will benefit all aspects of the business.

Core Workflow Implementation

During Rollout 1, a substantial 38% of the core workflows required for all business classes were successfully implemented. This achievement represents a significant step forward in streamlining operations and ensuring consistent processes across the organization. By incorporating these essential workflows, the CARES Debt Manager system enables efficient handling of debt management tasks, resulting in increased productivity and improved service delivery.

Integration with Partner Systems

Another crucial accomplishment of Rollout 1 was the successful implementation of primary interfaces between external and internal AGO Systems. This integration allows for seamless operationalization of the Debt Manager system, facilitating smooth data exchange and collaboration between various stakeholders. By establishing these interfaces, the system maximizes efficiency, minimizes manual intervention, and enhances overall data accuracy.

On-Premises Infrastructure Deployment and Security Controls

Rollout 1 also encompassed the implementation of the primary infrastructure "on premises," ensuring a robust and secure environment for the new Debt Manager system. This step involved setting up essential hardware, software, and networking components to support the system's operations. Moreover, stringent security controls were put in place to safeguard sensitive data and protect against potential threats, providing stakeholders with confidence in the system's integrity.

Customized Training Courses for the State of Ohio

Recognizing the importance of training and knowledge transfer, Rollout 1 included the development and customization of core Debt Manager Training courses specifically tailored for the State of Ohio. These courses equip users with the necessary skills and understanding to effectively utilize the system's features and functionalities. By providing comprehensive training, the State of Ohio ensures a smooth transition and optimal utilization of the new Debt Manager system.

Implementation of Secure File Transfer Protocol and Certification File Layouts

To enhance data integrity and streamline data exchange processes, Rollout 1 implemented Secure File Transfer Protocol (SFTP) standards and established common Certification File Layouts. These measures enable secure and standardized data transfers, ensuring that certifications from the State of Ohio are seamlessly processed within the Debt Manager system. By adhering to these industry best practices, the system promotes data consistency, reliability, and compliance.

Conclusion

Rollout 1 marked a significant achievement in the overall implementation process. Further, it played a crucial role in confirming the system's functionality and establishing a strong foundation for future enhancements. By implementing core workflows, integrating partner and internal systems, deploying a robust infrastructure, providing customized training, and ensuring secure data transfers, Rollout 1 has set the stage for a successful and efficient Debt Manager system. The benefits derived from this initial phase will be felt across all aspects of the business, enhancing workflows, integrations, letters, and reports for improved processes and outcomes.

Introducing Enhanced Features and Data Migration for State Client Services

Rollout 2 marked an important milestone in the CARES Debt Manager implementation where, for the first time, a full business class (with all business functionality) was completed July 10, 2023. Rollout 2 included the remainder of client agencies that are a part of the State Client Services (SCS) business class. Furthermore, this Rollout involved the migration of legacy data from the old system, and the introduction of new workflows including Special Counsel and Third-Party Vendor collections.

Data Migration

To ensure a smooth transition, the AGO CARES Conversion Team was responsible for migrating legacy data and accounts to the updated Debt Manager platform. This comprehensive data migration process encompassed the extraction of data from the existing databases; conversion into a usable format for loading into Debt Manager; and subsequent parsing, normalization, cleansing, and transformation of legacy data. The expertise of the C&R Software team was instrumental in loading the converted legacy data into Debt Manager, thus ensuring data integrity throughout the migration process.

Workflows and Interfaces

Rollout 2 introduced a range of workflows and interfaces to enhance the operational efficiency and functionality of CARES Debt Manager. C&R Software configured and implemented a total of 20 workflows, five of which were specifically designed to cater to the needs of Special Counsel and Third-Party Vendors. Additionally, 19 interfaces were developed, with six specifically tailored to facilitate seamless integration with Special Counsel and Third-Party Vendors.

Debt Manager Upgrade and Portal

As part of the Rollout 2 enhancements, C&R Software upgraded Debt Manager to version 12.0. This upgrade not only delivered the newly developed portal but also provided advanced accounting features, enabling a more robust and comprehensive financial management system. The portal, which will continue to be enhanced and upgraded in future rollouts, provides client, Special Counsel, and Third-Party Vendors with enhanced accessibility to critical information in a secure manner.

Conclusion

Rollout 2 represented a significant step forward in the evolution of the CARES Debt Manager system implementation. By implementing the remaining SCS business class clients, migrating legacy accounts, and introducing new features, Rollout 2 objectives aimed to enhance operational efficiency, improve data integrity, and facilitate seamless integration with external systems. The diligent efforts of the AGO CARES Program Team, in collaboration with the expertise of C&R Software, ensured a successful transition and paved the way for a more streamlined and feature-rich Debt Manager system.

Rollout #3 Objectives

The third rollout of CARES Debt Manager Implementation Phase marked a crucial milestone in optimizing debt management and client services. Below are the key objectives which drove the completion of that phase:

- Implement Bureau of Workers Compensation Business Class: Seamlessly integrate BWC business class into Debt Manager for all new and active accounts, enhancing efficiency for BWC-related cases.

- Migrate Active Legacy Accounts: Migrate active legacy accounts from CUBS to Debt Manager, consolidating data and accounts into the new system for a unified debt management approach.

- Integrate New Liens Portal: Introduce the new Liens Portal into Debt Manager, providing enhanced capabilities for efficient lien management.

- Upgrade DM Client Portal Features: Enhance the Debt Manager Client Portal to ensure a user-friendly experience and improved functionality, including updating account information and various other features.

- Validate Business Class Implementation Approach: Thoroughly validate the integration of BWC business class in a single rollout to fine-tune strategies for future rollouts.

- Leverage Foundational Workflows, Interfaces, Letters, and Reports: Utilize existing foundational workflows, interfaces, letters, and reports for maximum efficiency and consistency in the implementation process.

Implementation Items

The successful implementation of Rollout #3 required attention to various components:

- Workflows: Develop or adapt 11 workflows to accommodate BWC business class requirements and streamline debt management operations.

- Interfaces: Create 16 interfaces to enable seamless data exchange between different systems, ensuring real-time and accurate information flow.

- Letters: Design customized letters to cater to BWC-related accounts and specific debtor communication needs.

Data Migration

The data migration approach ensured seamless extraction of legacy CUBS data for uploading into Debt Manager, minimizing impact on clients. Quality editing, formatting, and standards are enforced up front in the new system.

The CARES Conversion Team was responsible for migrating BWC legacy data and accounts to Debt Manager, including new certifications. They also extracted active accounts from CUBS data and uploaded them to Debt Manager. Additionally, the team, along with Collections, processed legacy data for conversion, while C&R Software reconciled the conversion results.

Conclusion

The CARES Debt Manager Implementation Phase Rollout 3 for the Bureau of Workers Compensation was a significant step towards modernizing debt management processes. With a focus on efficiency, client satisfaction, and scalability, we are committed to delivering top-notch debt management services to our clients. The rollout began on August 4, 2023, and went live with the required updates and Bureau of Workers Compensation portfolio on June 3, 2024. Stay tuned for more updates as we progress on this exciting journey!

Rollout Details

Our CARES Program Strategy continues to focus on implementing the new Collections System incrementally. We will phase in all supported clients by business class while focusing on validating that Debt Manager can handle our new certifications and legacy accounts.

With this focus in mind, the following objectives have been established for the fourth rollout of the CARES program:

- Implement Personal Income Tax (PTAX) Business Class: Seamlessly integrate PTAX business class into Debt Manager for all new and active accounts, enhancing efficiency for PTAX-related cases

- Migrate Active Legacy Accounts: Migrate active PTAX legacy accounts from CUBS to Debt Manager, consolidating data and accounts into the new system for a unified debt management approach

- Leverage Foundational Workflows, Interfaces, Letters, and Reports: Utilize standardized foundational workflows, interfaces, letters, and reports for maximum efficiency and consistency in the implementation process

- Implement our new automated Skip Tracing feature to further enhance the efficiency of debt collection efforts

- Implement the Offer-In-Compromise (OIC) program in Debt Manager to ensure Ohio taxpayers still have the opportunity to avail themselves of this program once the PTAX class migrates to Debt Manager

- Implement TOPS/OTOPS Offset and Ohio Lottery Commission Real-time interfaces to help optimize collection efforts on eligible debts

- Implement our Electronic Bankruptcy Interface with the Defense Logistics Agency to assist the business with obtaining Bankruptcy information in an increasingly efficient manner

- Implement SOVOS-1099 Interface to ensure timely generation of 1099s once the PTAX business class is migrated to Debt Manager

Implementation Items

- Workflows: Develop and/or adapt approximately 55 workflows (of which 7 are new) to accommodate PTAX business class requirements and streamline debt management operations.

- Interfaces: Create 22 interfaces to enable seamless data exchange between different systems, ensuring real-time and accurate information flow.

- Letters: Design approximately 50 customized letters to cater to PTAX-related accounts and specific debtor communication needs.

- Reports: Design 3 new reports to ensure accurate and timely reporting of necessary collections statistics.

- Continued onboarding (testing appropriate interfacing capabilities) of Special Counsels and Third Party Vendors to ensure their preparedness for debt collection from the new Debt Manager system.

Data Migration

The data migration approach ensures seamless extraction of legacy CUBS data for uploading into Debt Manager, minimizing impact on clients. Quality editing, formatting, and standards are enforced upfront in the new system.

The CARES Conversion Team is responsible for migrating PTAX legacy data and accounts to Debt Manager, including new certifications. They will also extract active accounts from CUBS and upload them to Debt Manager. Additionally, the CARES Conversion team, along with Collections, will process legacy data for conversion and reconcile the results. In continuation of the process, C&R Software will load the reconciled legacy data into Debt Manager and provide reporting to the AGO for resolving any issues identified during the load.

Conclusion

The CARES Debt Manager Implementation Rollout 4 for the Personal Income Tax business class is another significant step towards modernizing debt management processes. With a continued focus on efficiency, client satisfaction, and scalability, we are committed to delivering top-notch debt management services to our clients. The Rollout 4 planning phase begins on July 1, 2024, with design sessions commencing on July 29, 2024. We eagerly anticipate Go Live by late summer 2025. Stay tuned for more updates as we progress on this exciting system conversion journey!